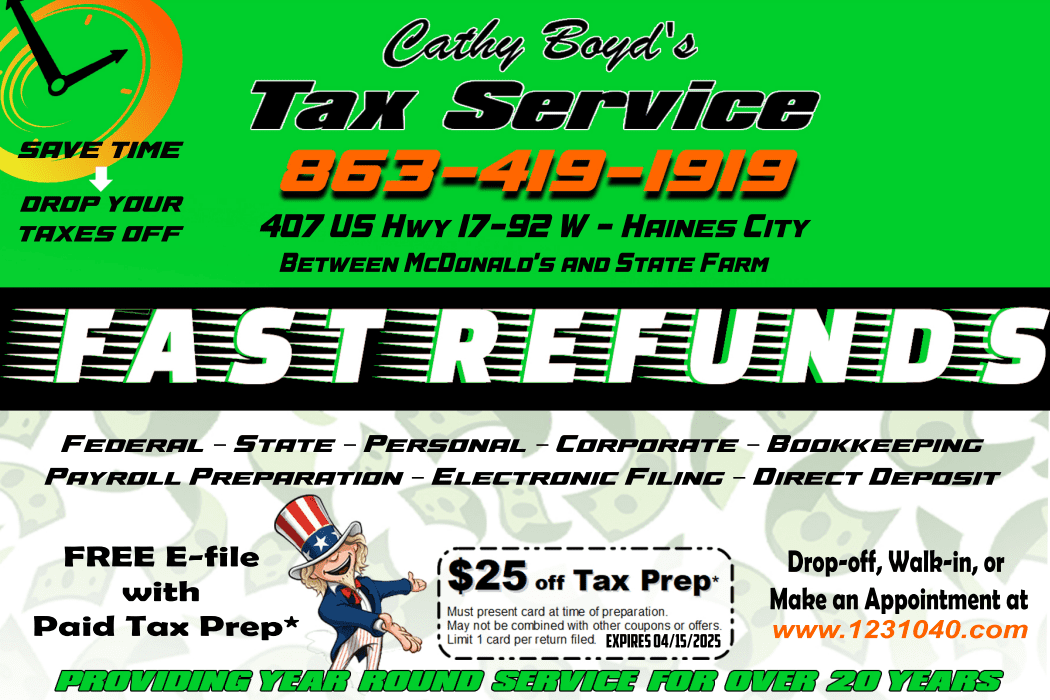

Payroll & Tax Services in Haines City, FL

Need help with your payroll & taxes? We can assist with federal, state, personal, corporate, bookkeeping, payroll preparation, electronic filing, and direct deposit. Call us at (863) 419-1919 or click on the schedule an appointment button above today!

Running a successful business entails juggling various tasks and responsibilities. Financial obligations may be essential to your organization’s stability and success; however, these operations can also be complicated. Furthermore, your company may lack the resources and expertise to conduct various tasks on its own. Fortunately, hiring outside help for various financial responsibilities, such as managing payroll and paying taxes, can be helpful.

What Are Payroll Services?

Managing payroll is a critical but often challenging aspect of this endeavor. Fortunately, professional payroll services can offer invaluable support in this area, helping businesses streamline operations, limit errors and maintain consistent functions. Specifically, payroll firms may provide the following benefits:

- Precision—Professional payroll services may utilize advanced software and systems to ensure that your employees are paid accurately and on time, eliminating the risk of errors that could lead to dissatisfaction among your workforce.

- Compliance—Various payroll-related laws, such as those involving taxes, may be complex and subject to frequent changes. Professional payroll service providers stay up-to-date with these regulations, reducing your business’s exposure to potentially costly penalties.

- Efficiency—Managing your company’s payroll may demand time and resources that could be better allocated elsewhere. Outsourcing payroll services allows your team to focus on core tasks while the experts handle payroll efficiently.

- Growth—Professional payroll services are equipped to handle scalability and can adapt their services to meet your evolving needs.

- Cybersecurity—Payroll data is sensitive and confidential. Professional payroll services prioritize data security, implementing robust measures to protect your information from breaches and unauthorized access.

What Are Tax Services?

Navigating the ever-changing landscape of tax regulations can be daunting for businesses of all sizes. Professional tax services offer their expertise to help businesses enjoy various advantages, such as the following:

- Improved planning and strategizing—Tax professionals can help your business identify opportunities for tax savings, optimize deductions and credits, and structure transactions in a tax-efficient manner.

- Assured compliance—Maintaining compliance with tax laws is crucial to avoid penalties and legal issues. Tax professionals meticulously prepare and file your business’s tax returns, ensuring accuracy and adherence to all applicable regulations.

- Audit representation—Tax professionals can represent your interests, provide documentation and negotiate with tax authorities to resolve issues in your favor.

- Better time efficiency—Handling tax matters internally can be time-consuming and resource-intensive. Tax professionals allow you to focus on your core business activities while qualified professionals manage tax-related tasks.

- Professional insight—Tax services can offer valuable financial guidance, such as helping your business make informed decisions and structuring transactions and investments while minimizing tax liabilities.

We’re Here to Help

At Cathy Boyd's 1st Class Insurance Services, we have over two decades of experience serving the central Florida area. Our team will draw on its extensive collective knowledge to help your business understand and implement optimal steps to secure its finances and future. Contact us today to get started.